Unable to pay your EMIs? This is what you can do ⚒️

Debt & Loans

|

Aug 29, 2020

With a 62% increase in women borrowers, Indian women are not only borrowing much more than they did before but also funding their own education or buying houses and cars with these loans.

Taking a loan also comes with the responsibility of repaying your dues on time. Job loss, medical emergency, high household expenses - there are various situations that can cause a cash crunch and prevent you from paying your EMIs on time. So what do you do in such times? Let’s understand the impact of defaulting on your loan repayment and what you can do to rectify the solution.

What is the impact of defaulting on my EMI?

Late fees and penalty charges

Lowered credit score

Difficulty in obtaining a loan in the future

Higher interest rates on existing and future loans

Your co-applicant/ guarantor becomes liable to repay the dues

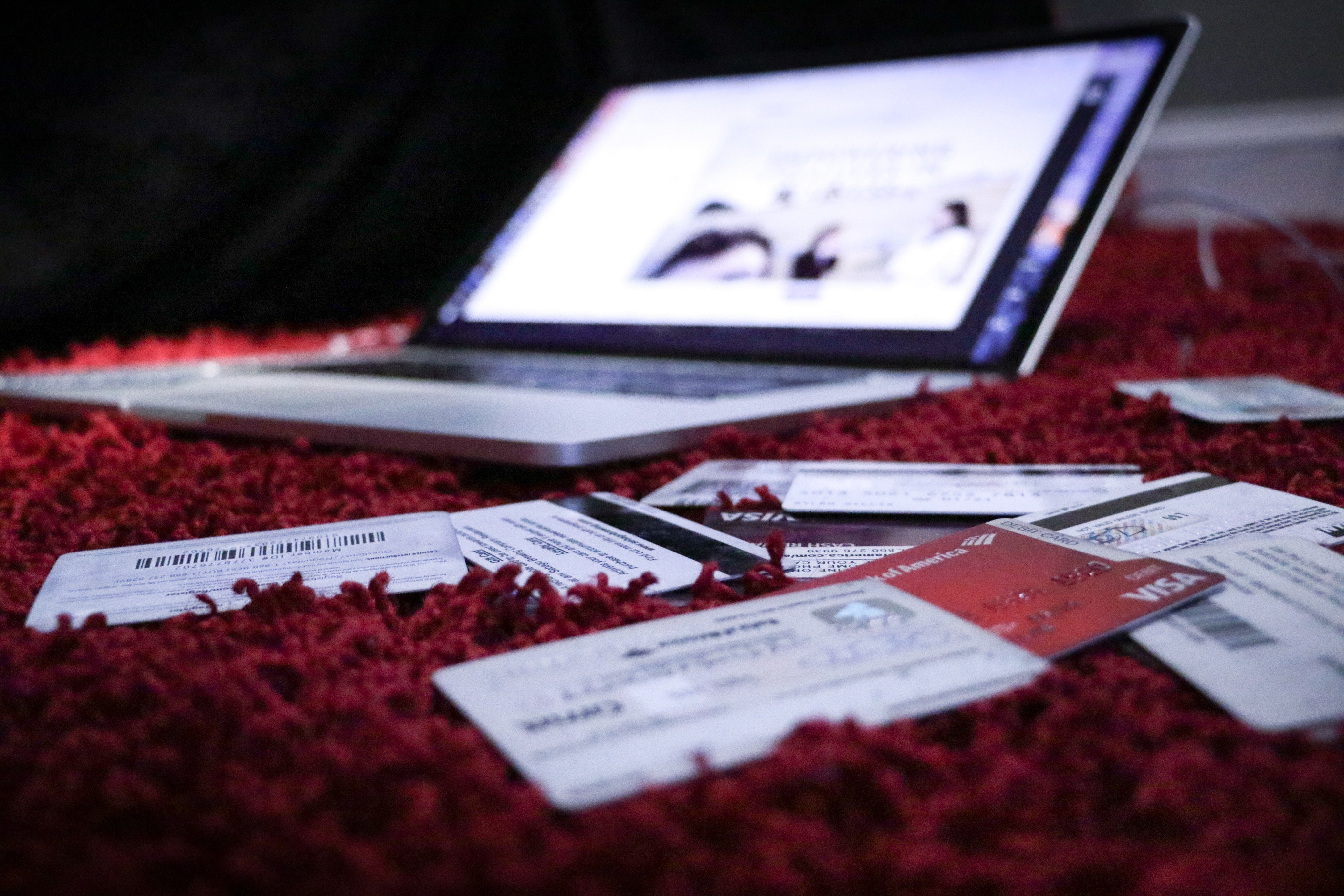

If it is a credit card bill, you have to pay excessively high-interest rates on the outstanding amount and your credit limit will be reduced.

If it is a home/car loan, you may lose possession of your home/car.

What happens if I default on my Credit Card bill/ Personal Loan EMI?

If you are unable to pay credit card dues for 1 or 2 consecutive months, the lender will send multiple reminders to clear the outstanding dues. While this is not counted as a default, your credit score will be negatively impacted. You will also have to pay a penalty fee, though some lenders give an additional grace period during which no late payment charges apply.

If you do not clear dues for more than 3 months (time varies from lender to lender), a default notice is sent to you. At this point you can try and negotiate with the lender. If you fail to come to an understanding with the lender, a police complaint can be filed or legal proceedings can be initiated against you. The lender can also engage the dreaded Loan Recovery Agents to make you repay the amount.

If you are still unable to pay the dues, your account is classified as a Non-Performing Asset and the lender can file a lawsuit against you or sell your debt to a debt collection agency.

What happens if I default on a Secured Loan (Home or Car Loan) EMI?

For the first 3 months (90 days) of not paying your EMIs, you are only charged interest on your dues and will receive continuous reminders from the lender to clear your dues.

If you fail to pay your EMIs for 3 consecutive months, lenders consider it as a default and take action. The lender will then send you a notice of default, giving a period within which you must repay the outstanding amount or lose possession of the asset (house/car) that you have provided as a collateral.

If you are unable to pay your dues within the period mentioned in the notice, the lender will take possession of the asset. An auction is then held to sell this asset to the top bidder. The money received from the sale of asset is used to settle your dues and pay the auction expenses.

If the money received from the sale of the asset is not enough to clear your outstanding dues, you are liable to pay the balance. If you fail to repay this outstanding amount as well, the lender will appoint a third party debt collection agency to recover the dues and may also initiate legal proceedings.

What should I do if I am unable to pay my EMIs?

Take Loan Insurance in advance – While taking a high value loan like a home loan, it is advisable to also take a loan insurance (loan protection insurance). This insurance will cover for your missed EMI payments for a short period in case of genuine reasons like job loss or medical emergency.

Use your Emergency Fund – The very purpose of Emergency Funds is to rescue you in bad situations. You can utilize your Emergency Fund to repay your dues.

Raise funds by selling assets – You can sell assets such as a property bought for investments or jewellery to clear your outstanding dues.

Negotiate with your lender – If you have been regular in paying your dues and a genuine reason has made it difficult for you to repay the loan you have the following options -

1. Deferring payment – By assessing your credit history and situation the lender may give you temporary relief to skip a month or two of EMIs. However, you will be charged a penalty during this grace period.

2. Reduction in EMI – The lender may reduce your EMI by either increasing the loan tenure or reduce the interest rate.

3. One time settlement (OTS) – The lender permits you to make a one-time payment to settle your dues by reducing the principal and waiving of the interest and charges. The OTS option drastically reduces your credit score and finds a mention in your credit report as well.

Bottom Line

Always keep in mind your income before taking a loan. The total of all your EMIs should not be more than 50% of your income. Even with considerable planning, you may still face an unforeseen situation that might impact your ability to repay your EMIs. In such cases, instead of running away from the lender, you should try and come to a compromise with your lender. While lenders specify the terms and conditions with respect to defaults in the loan agreement, they are open to negotiating and finding a solution, if you default on your loan.

Download the Basis app now!

This article is written by Namrata Patel for Basis

Basis is a first-of-its-kind platform, aimed at enabling women to achieve financial independence through expert advice, in-app knowledge Boosters and supportive communities.

#loan #mortgage #money #realestate #finance #loans #personalloan #homeloan #business #refinance #credit #realtor#bank #mortgagebroker #lending #home #cash #personalloans #lender #investment #realestateagent #homeloans#entrepreneur #creditrepair #carloan #businessloan

Read More

Unleashing Alexis Rose's PR Magic: Building Her Own Empire

Aug 29, 2020

Unlocking your go to guide to navigate Gold 🌟

Aug 29, 2020

Investing in Gold 101 - A handbook on why, and how to invest in Gold

Aug 29, 2020

Is Taylor Swift REALLY saving the US Economy?

Aug 29, 2020

6 Lessons from The One-Page Financial Plan by Carl Richards

Aug 29, 2020

5 Reasons You Need a ̶P̶r̶e̶p̶a̶i̶d̶ Power Card

Aug 29, 2020