Zomato IPO - What you should look for before investing

News

|

May 10, 2021

It’s honestly all that we can talk about right now. Zomato, another IPO this year and the Indian market is talking all about it. Post their announcement, Zomato has raised many eyebrows. For the good? Let’s find out!

Zomato is looking to raise up to $1.1 billion, according to its draft red herring prospectus released on April 28 and is in discussions with investors for a $200-million pre-IPO sale of stock.Founded in 2008, Zomato has seen tremendous growth. From initially being just a restaurant listing service, Zomato expanded to a food delivery platform, to now developing tools for restaurant owners to acquire customers, and hyperpure, where it provides ingredients and kitchen products. Sounds good, doesn’t it?

Now let’s discuss the numbers:

Active restaurant listings 3,50,174.

Active food delivery restaurants 14 million Present in 526 cities in India and

24 countries outside India

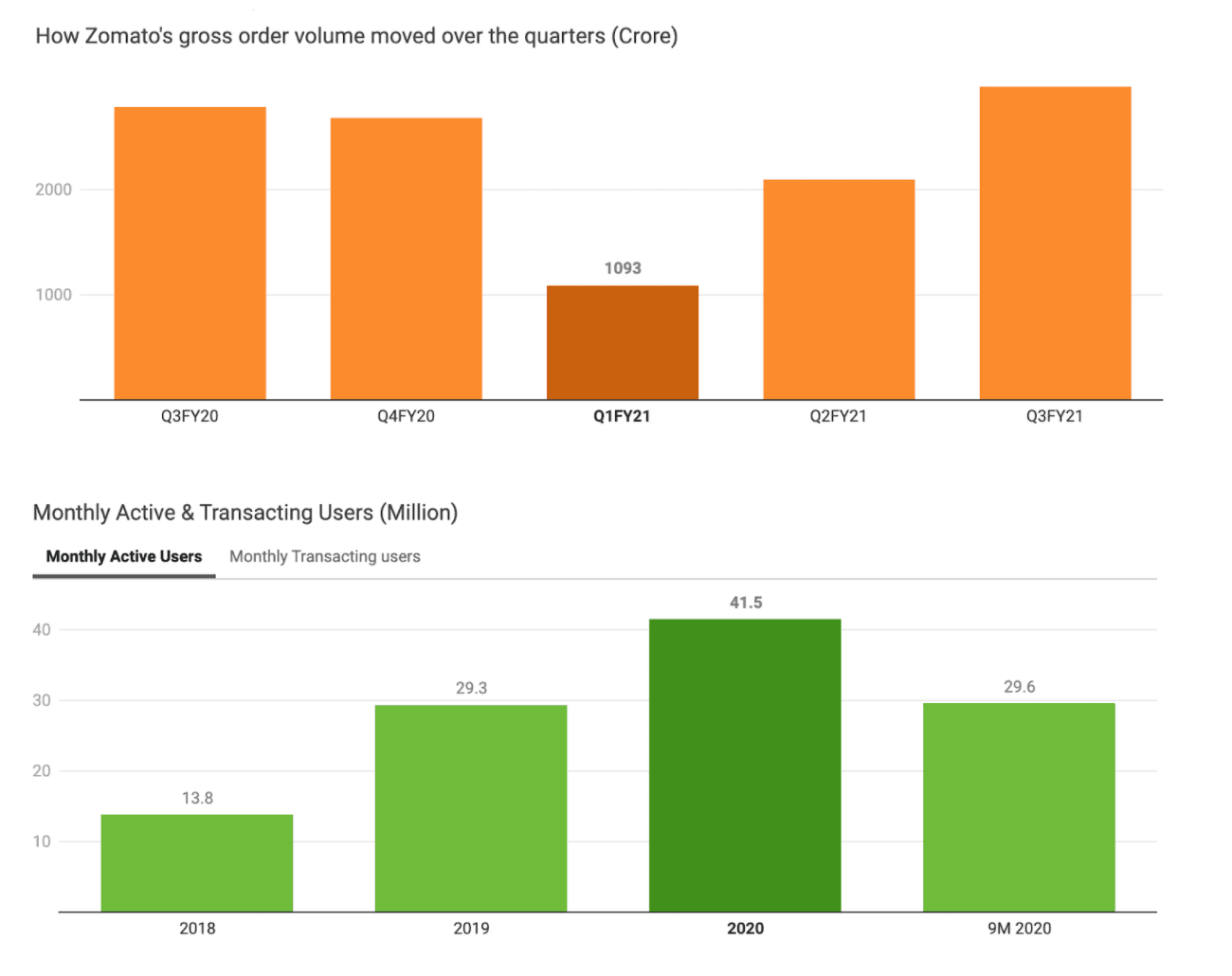

The number of orders rose from 30 million to 4031 million in FY20.

But that’s not all, Zomato saw a sharp upward trend during the lockdown in India. With Millennials and GenZ staying at home, trying to cope with the pandemic, they ended up being the main customers while fast-food chains like Domino’s and McDonald's, the most popular.

But is there a dark side too?

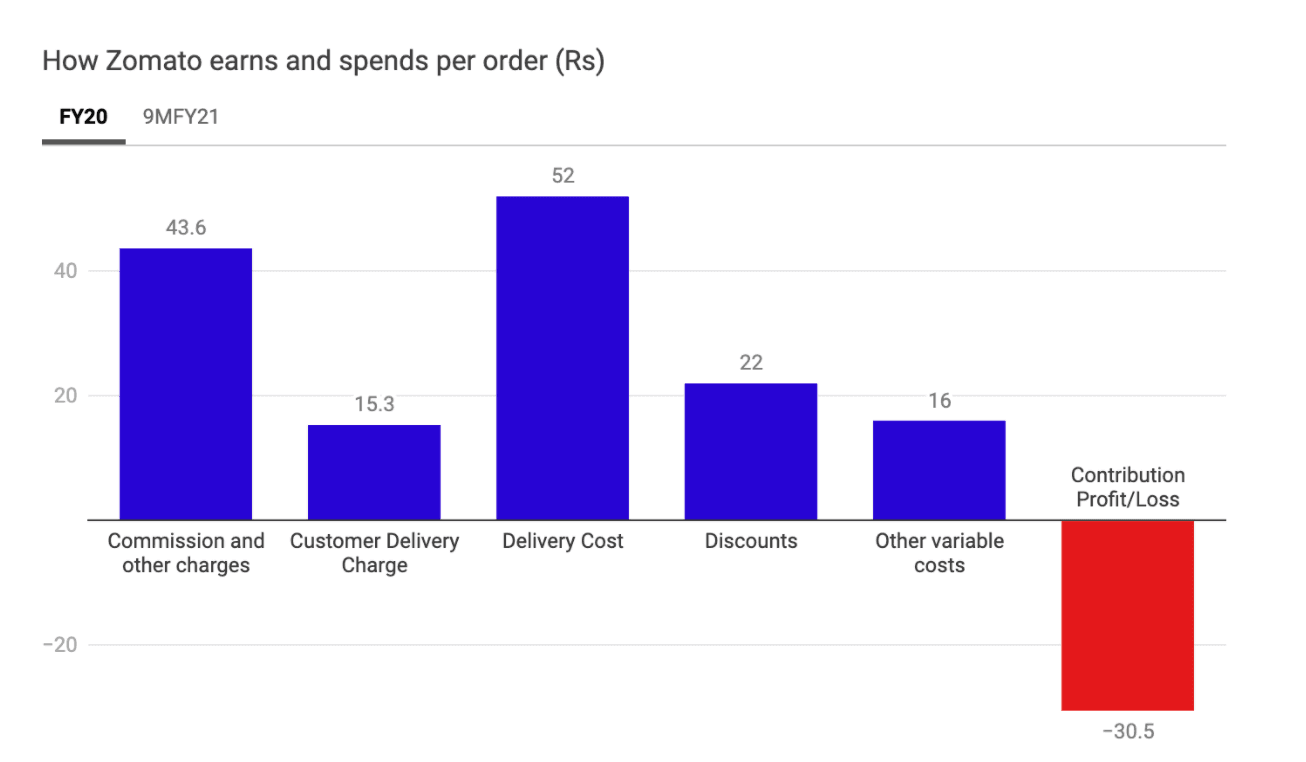

So while we look at the fantastic numbers of Month on Month growth for Zomato, there are a few things that the firm was also falling behind on. In the last year, Zomato earned only 44% more than before on commissions. This was despite charging consumers 75% more per delivery. Why the difference? With delivery costs going down by 15% coupled with card discounts by 66%, Zomato was making a loss of ₹ 30.5 per delivery. However, by the end of December 2020, Zomato was making ₹ 22.9 which is a massive improvement from loss-making earlier.

What does this mean for you?

Zomato has been a testimony of how fast a startup can grow. In just a few years, the firm has moved rapidly in the food-tech market and revolutionized how people order food takeouts.

Following its IPO, Zomato will be listed on BSE and NSE.

While there’s all the hype about Zomato and its success, here are some crucial learnings that we as investors can look at.

Noise is not equal to value: Sure, the IPO is making heads turn. But don’t let that make you blindly invest. Look at the numbers very closely and build your conviction for the future growth of the company. Zomato themselves have said that they are far from profit-making. So, is that a chance you’d like to take? Evaluate and then decide.

The stock market is a test of time: If you’re looking to make a quick buck on the market and leave, that might not work in your favour. It is always good to stay invested in the long term. This means, seeing your funds through good times and bad. So, take a good look at the documents and then decide if you’re someone who would like to nurture a long term investment with Zomato.

Read More

Unleashing Alexis Rose's PR Magic: Building Her Own Empire

May 10, 2021

Unlocking your go to guide to navigate Gold 🌟

May 10, 2021

Investing in Gold 101 - A handbook on why, and how to invest in Gold

May 10, 2021

Is Taylor Swift REALLY saving the US Economy?

May 10, 2021

6 Lessons from The One-Page Financial Plan by Carl Richards

May 10, 2021

5 Reasons You Need a ̶P̶r̶e̶p̶a̶i̶d̶ Power Card

May 10, 2021